Investisseurs

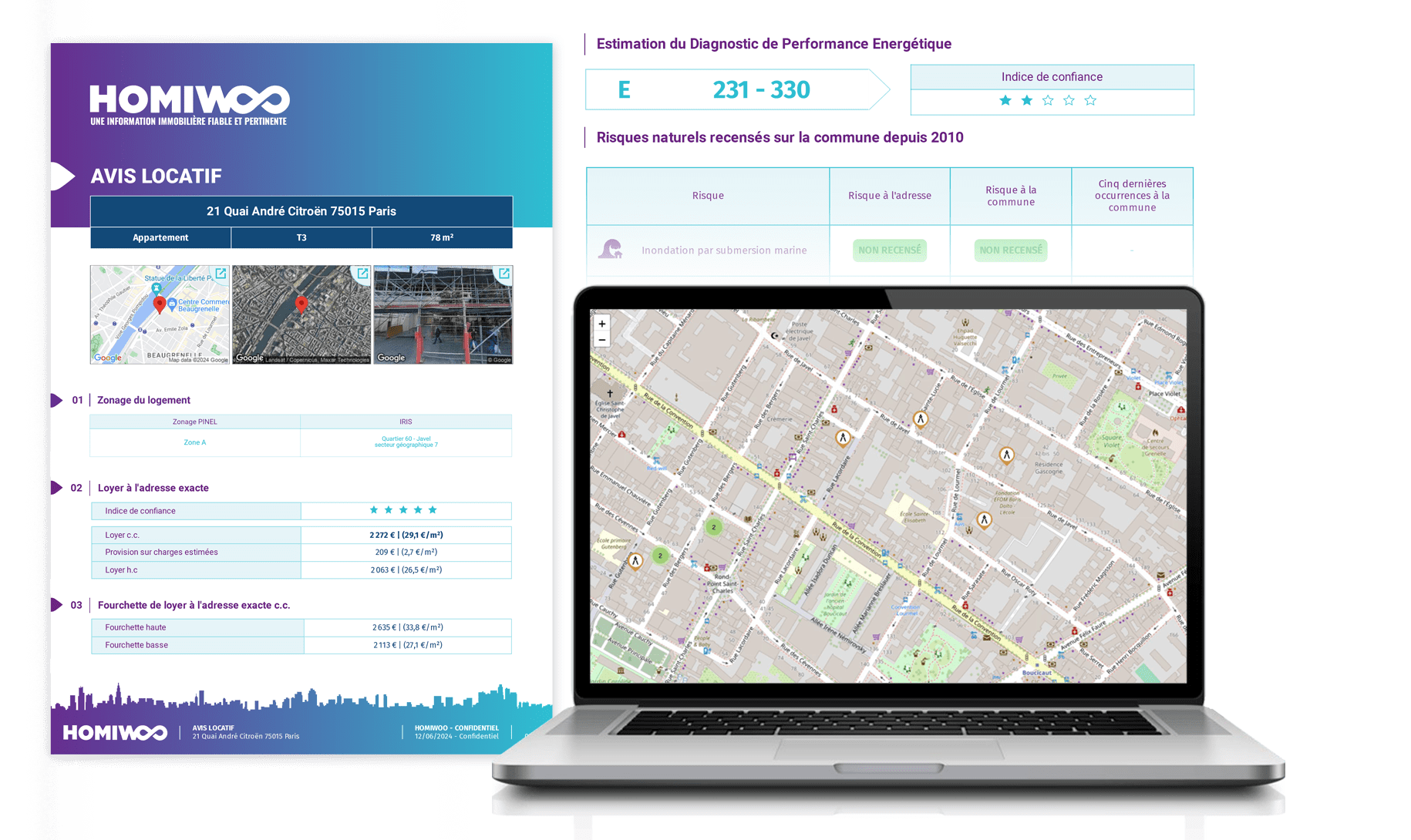

Notre plateforme web permet de consulter des rapports PDF ainsi que des cartes. Toutes les données disponibles sur la plateforme sont également accessibles via des API. L'accès à la plateforme et aux API est soumis à la souscription d'un forfait annuel qui permet l'utilisation de crédits correspondants.

- Valorisation instantanée

- Potentiel de réversion

- Dynamique du portefeuille

Optimisez vos investissements avec une analyse précise des portefeuilles immobiliers

Évaluer le potentiel d'un portefeuille immobilier lors de son acquisition est une étape cruciale pour s’assurer qu’il correspond à votre stratégie d’investissement. Dans un marché immobilier dynamique et concurrentiel, il est essentiel de disposer d'informations fiables pour évaluer le cash on cash et le potentiel de réversion d'un portefeuille.

Homiwoo offre la possibilité d'effectuer une analyse approfondie des portefeuilles immobiliers que vous envisagez d'acquérir. Grâce à des algorithmes avancés et des données en temps réel, Homiwoo vous fournit des indicateurs clés tels que la rentabilité potentielle, les tendances du marché, la rotation de marché et les risques climatiques. Ces informations vous permettent d'évaluer rapidement les opportunités d'acquisition, d'identifier les actifs les plus prometteurs et d'analyser un grand nombre d'opportunités avec efficacité.

Béatrice GUEDJ

- France / Dom-Tom

- Historique 3 ans

- Anticiper

Accédez à des informations stratégiques pour appuyer vos décisions lors des comités d’investissements

La maximisation de l'alpha d'un portefeuille immobilier est un objectif clé pour les investisseurs institutionnels. Dans cette quête, la data intelligence joue un rôle crucial, offrant des informations et des analyses approfondies pour prendre les meilleures décisions.

Grâce à la data intelligence, les investisseurs peuvent tirer parti des opportunités d'arbitrage. En analysant en profondeur les données sur les loyers, les taux d'occupation et les coûts d'exploitation, ils peuvent comparer leur portefeuille au marché. Cette analyse comparative leur permet de repérer les forces et les faiblesses de leur portefeuille, identifiant ainsi les domaines où des ajustements stratégiques sont nécessaires pour maximiser leur alpha.

Homiwoo offre aux investisseurs les indicateurs métiers nécessaires pour maximiser l'alpha de leur portefeuille immobilier et ainsi surperformer le marché immobilier.

Florian DUSSERT

- Arbitrage

- Relocation

- Stratégie ESG

Suivez les marchés immobiliers sur toute la France pour chaque région, département, commune, ville ou quartier

Pour les investisseurs institutionnels actifs sur le marché immobilier, disposer d'observatoires immobiliers est essentiel pour prendre les meilleures décisions. Ces données incluent les prix et loyers des biens immobiliers, les taux de rotation, les tendances démographiques, et bien d'autres indicateurs qui influencent le marché immobilier.

Ces observatoires immobiliers sont des outils puissants qui fournissent des informations précises et actualisées sur les tendances, les performances et les opportunités du marché immobilier. Grâce à ces données, les investisseurs institutionnels peuvent évaluer les risques, anticiper les évolutions du marché et adapter leurs stratégies d'investissement en conséquence. La connaissance du marché immobilier offre un avantage concurrentiel certain.

Les observatoires immobiliers permettent également de surveiller les performances des investissements existants, d'optimiser les rendements et d'ajuster les stratégies pour maximiser la performance globale du portefeuille immobilier.

Les observatoires immobiliers d’Homiwoo fournissent aux investisseurs une vision complète du marché immobilier, leur permettant de prendre des décisions stratégiques basées sur des données fiables.

AEW : European Research Monthly Update